'Winter

has come for the Chinese economy,' says Taiwanese expert

By Jessica Mao and Angela Bright

April 20, 2023 Updated:

April 20, 2023

Young people attending a

job fair in Beijing on Aug. 26, 2022. Amid China's slowing economy, they face

an increasingly uncertain future, says an economist. (Jade Gao/AFP via Getty

Images)

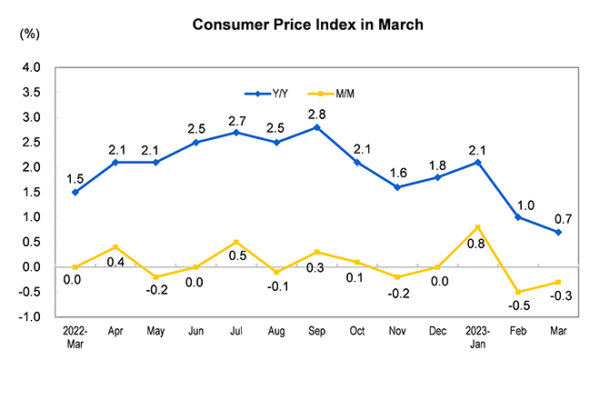

China’s consumer price index (CPI) and producer price index (PPI) data for March both fell short of expectations year-on-year. The communist regime’s economic development model is in a vicious cycle of balance-sheet recession, says an economist, and this is just the tip of the iceberg. China’s economic winter will worsen, he predicts.

China’s CPI rose just 0.7

percent year on year in March, its slowest pace since September of 2021, and

down 0.3 percentage points from February, according to data released by the National Bureau of

Statistics of China on April 11. An analysis by Chinese news website

Caixin suggests that aggregate demand remains

weak.

Meanwhile, China’s PPI

fell 2.5 percent year on year in March, an additional decrease of 1.1

percentage points, hitting its lowest level since July 2020.

Both figures were below

consensus estimates from Wind, a Chinese provider of financial data and

analytics tools, according to the South China Morning Post.

Just the Tip of The Iceberg: Taiwanese

Economist

Elliott Fan, a professor and vice chair of the

Economics Department at National Taiwan University, believes that the economic

development model of the Chinese Communist Party (CCP) is broken. The current

numbers are just the tip of the iceberg, he says. In economics, the situation

is known as a balance-sheet recession.

“This is very similar to

what happened in Japan after the bubble economy burst, which means that China

is actually going down the same path,” Fan told The Epoch Times on April 12,

saying China’s economic development model largely replicates the problems of

Japan’s real estate bubble economy in the 1980s and 1990s.

“The core of the problem

is debt issuance,” he said. “Debt is an interesting thing. It’s a very

important factor in economic growth.”

“For example, if I have a

company and want to develop a project, I am not likely to use my own money. I

must borrow money, that is, from the bank. If the project has great development

potential and makes a lot of money in the medium and long term, I will pay back

the bank. This is a normal economic operation. In other words, debt is

necessary to promote economic development.”

Normal economic

operations are complicated, however, by corruption and government collusion, he

added. “The problem of collusion between government and businesses is very

serious in China. There are many privileged people who borrow money from banks,

and the banks dare not refuse to lend it, but these projects are actually not

profitable.”

“In the process, however,

many people get benefits in various ways and split the money, [but] the

projects cannot develop well, so they cannot make money. When there is more of

this kind of debt, it has a negative impact.”

Elliott Fan, professor and vice chair of

the Economics Department at National Taiwan University. (Courtesy of Elliott

Fan)

Good

and Bad Debt

There are always good

debts and bad debts in society, and a healthy economy should have a mechanism

for allocating money to good debts, which will then reduce the chance of bad

debts, Fan said. This is the basic environment that will allow a healthy

economy to grow and develop continuously.

“But China is out of that

basic environment,” he said. “The problem lies in that the CCP has issued too

much debt in the past, and it’s focused on real estate.”

“Why does real estate

always create financial problems? Why is it always a big problem? The reason is

psychological expectations.”

There are many important

indicators of how society works, Fan explained, but not all have the same

psychological effect. While some of them do not arouse optimistic expectations,

indicators such as the stock market and financial assets can easily encourage

optimism, so when they rise, people expect them to continue to rise. Those

expectations frequently include the real estate market.

“In professional economic

study, the biggest fear is psychological expectations,” Fan said. “Why is it

troublesome when expectations develop? Because people become irrational. The

various policy adjustment tools that governments can adopt are effective only

when people are rational. When society as a whole becomes irrational, any

policy tool becomes ineffective.”

One of the reasons for

the property bubbles in Japan and China was inflated expectations, which led to

an inflated bubble, according to Fan. However, the CCP authorities did not deal

properly with the situation.

“Why? Because numbers

look beautiful,” he said. “Before the bubble burst, it was shiny and beautiful.

Everybody was making a lot of money. Weren’t they happy? Who wants to be the

whistle-blower? And what happened after the bubble burst, which is what’s happening

in China now, is called a balance sheet recession.”

Consequences of Balance-Sheet Recession

Fan said that in a free

economy, the consequences of a bubble bursting are severe in the short term

because the government does not usually intervene too much in the market.

However, the Chinese market is different, since the CCP controls all sectors.

“So what the CCP is doing

now is preventing [companies] from going out of business, because there will be

a chain of closures,” he said.

For example, if A lends B

$1,000, B then has the ability to lend that $1,000 to C, and so on, and the

debt can continue to cycle.

However, when that cycle

is interrupted or collapses, he said, “A closure chain will follow the

collapse, and the last guy will say, ‘I can’t make money. I have a loss and I

can’t pay that $1,000 back.’ Then it comes back from D, C, B, A. Nobody can pay

their debts.”

Fan believes that the

CCP’s approach is to prevent companies from closing by using a variety of tools

to extend debt maturities. The CCP’s assumption is that there will be no chain

reaction as long as companies do not close down.

On the contrary, Fan

said, this strategy only reduces the intensity of the problem, instead of

solving it, “because debts have to be paid sooner or later, and someone has to

pay them.”

“In the past, China’s

economy was largely driven by a lot of debt issuance, including housing,” he

said, but “that cycle has stopped now because the housing market is coming

down, the economy is shrinking, and the overall economy of the whole society is

going down.”

Fan noted that when debt

problems arise, the first challenge an individual or a company faces is the

inability to borrow money.

“In other words, his or

her entire economic activity is limited,” Fan said. “The investments and

activities he or she can do are limited, so investment will decrease.”

Secondly, consumption will

decrease. With too much debt, both individuals and businesses cut back on

spending, leading to a drop in consumption. When there is less consumption on

all fronts, prices will fall.

“That is to say, amid a

shrinking private demand, prices will definitely go down, so will inflation,

and even deflation will occur. Once deflation occurs, it will be hard for the

government to find any tools to deal with it.”

Fan said that price

weakness in China is an inevitable phenomenon. The reason why balance-sheet

recessions are difficult to clean up once they occur, and usually last for a

long time is that they form a vicious cycle.

“The vicious cycle means

that prices don’t rise, or in a worse case, a deflation leads to negative price

growth. This will greatly discourage investment, and poor investment will

create fewer jobs, so private consumption will further deflate,” he said.

‘An

Economic Nightmare’

Fan explained that the

economic mechanism of society has a cyclical nature. China is now in a cycle of

balance sheet recession, with prices, investment, and other economic factors

falling. As the government adopts austerity measures due to its lack of money,

everything is shrinking.

“The shrinkage of one

variable leads to that of another, and the cycle continues,” he said. “It’s an

economic nightmare.”

“That is to say, the

winter has come for the Chinese economy. It has come for a long time, and it’s

going to feel colder and colder now because all the indicators are starting to

move in that direction, and a cycle is slowly emerging. Once the cycle starts,

it’s going to last quite a long time.”

Fan said the CCP’s

numbers are dismal even if they have been “glorified.”

“Nobody knows the actual

numbers,” he said, “but from all indications, it looks very bad. I think one

important expectation is that these phenomena will not change in the short

term.”

“The balance sheet

recession is a particular recession,” he said. “It’s a very troublesome one,

and it’s a very large one.”

“The volume of the CCP’s

local debts and real estate bubbles [is] very large … so large that it cannot

be absorbed in a short period of time.”

Reuters contributed to this report.

https://www.theepochtimes.com/chinas-march-cpi-ppi-falls_5198892.html

No comments:

Post a Comment